Editor’s Note:

At Writes and Kulcha, we prioritise bringing relevant and impactful stories to our readers. In this piece, we explore the Jamaican Government’s strategic approach to disaster recovery, particularly in light of Hurricane Beryl. Rewritten based on an article by Lisa Rowe on the Jamaica Information Service (JIS) website, this story highlights the importance of financial preparedness and resilience. In the context of climate resilience, especially with the agricultural and property losses suffered during Beryl’s recent passage, such measures are crucial. Our ability to adapt and recover from natural disasters is vital for preserving our culture, ensuring food security, and maintaining our place in the global marketplace. We extend our gratitude to JIS for their comprehensive coverage and commitment to informing the public.

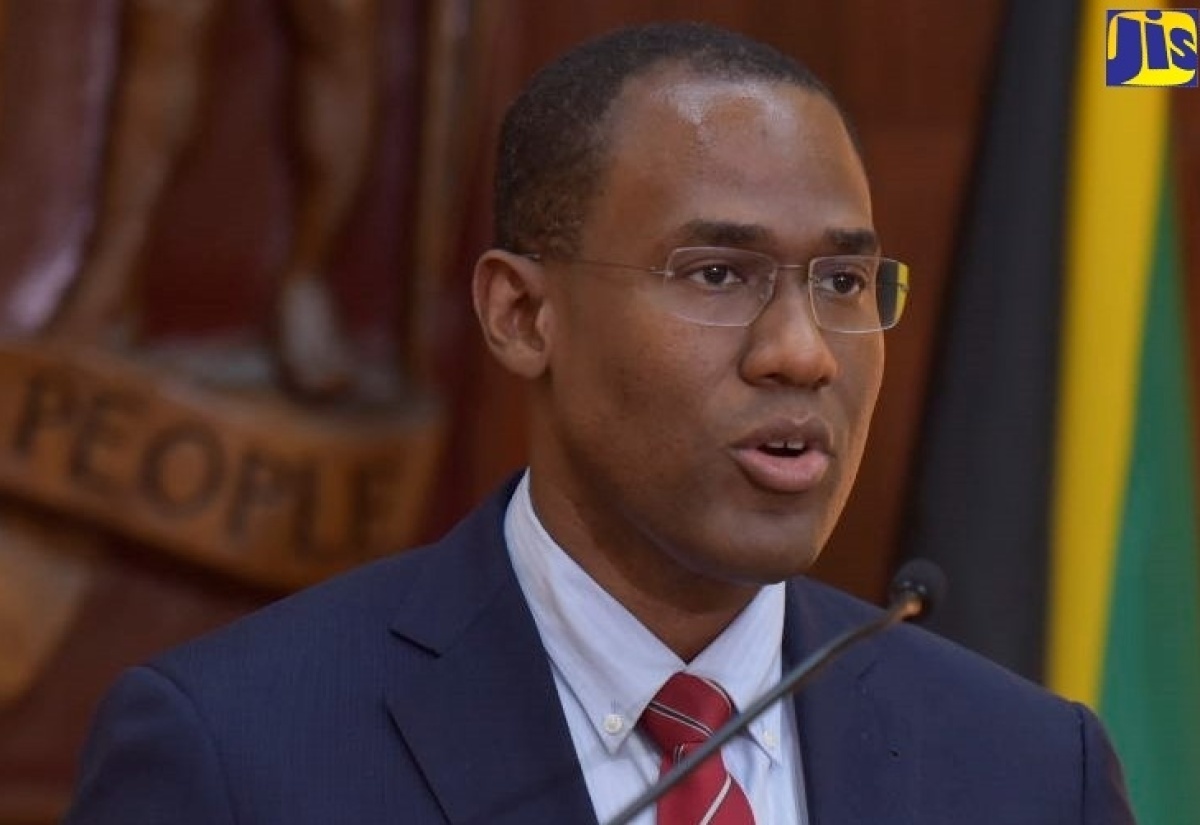

Jamaica’s government is optimistic about the country’s capacity to bounce back from Hurricane Beryl’s setbacks. According to the Minister of Finance and the Public Service, Dr. Nigel Clarke, despite the severe weather system’s path and intensity not triggering Jamaica’s Catastrophe Bond, there are other contingencies in place to ensure recovery.

The Catastrophe Bond is designed to provide Jamaica with financial protection against a Category Five or a very intense Category Four hurricane making landfall.

“The Government of Jamaica (GOJ) has strategically put in place a multi-layered set of financial instruments to pre-finance the emergency response and recovery costs of natural disasters,” Dr. Clarke said. He explained that while not all storms will trigger all instruments, the idea is to have access to resources from some instruments for every storm.

Preliminary assessments of the damage from Hurricane Beryl indicate that the Government will need to draw on resources from the first two layers of financial instruments: the Contingency Fund and the Natural Disaster Fund, totalling $4.5 billion. Additionally, the Administration may need to tap into the Inter-American Development Bank (IDB) Contingent Credit Line (CCL), which provides a maximum provision of approximately $46 billion.

Dr. Clarke has initiated the process to access funds under the CCL, stating, “it will take a few days to ascertain exactly how much of this Beryl will trigger as well as how much we will need.” He also highlighted other disaster funding arrangements in place due to the Government’s prudence and forward-thinking, including a $140-billion Precautionary and Liquidity Line (PLL) with the International Monetary Fund (IMF). The PLL can be drawn in the event of liquidity problems from natural disasters or economic shocks, although it is currently deemed unlikely to be needed for Beryl.

The Government will aggregate estimates of damage and required interventions over the next few days and finalise the total resources from disaster risk financing sources. Dr. Clarke emphasised that proactive disaster risk financing arrangements allow the Government to avoid scrambling for emergency funds in the aftermath of Beryl.

The National Natural Disaster Risk Financing Policy (NNDRFP), established last year following public consultations, aims to enhance Jamaica’s resilience in managing the aftermath of disasters. This policy focuses on pre-and post-disaster measures to ensure adequate financial capacity to handle disasters’ fallout, thereby improving the Government’s responsiveness without straining the national Budget.

The ultimate goal of this policy is to reduce the financial burden on the national budget while ensuring the government’s preparation and capacity to endure future natural disasters, which will certainly grow more frequent as a result of climate change.